What does it mean to be "upside down" on your car loan?

Being “upside down” on your car loan simply means the present value of the car purchased is lower than the present amount owed on the loan. For example, you buy a car for $13,000. A year later the value of that car is estimated at $7,000 and you owe $10,000. You are officially $3,000 upside down on the car loan.

This concept can happen with different types of loans, such as mortgages, motorcycles, boats and more. So how can you prevent this from happening?

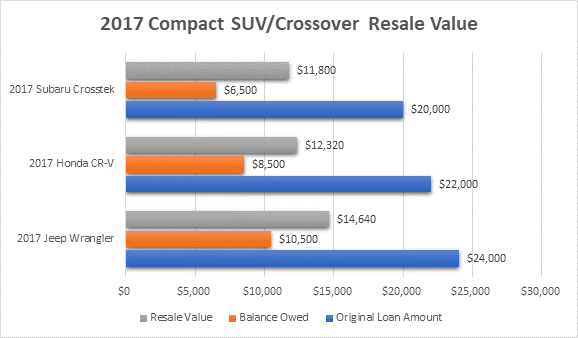

1. Check Resale Values Before You Buy a Car

When it comes time to look for a car, examine the types you are interested in and do some research on their resale value. You can use online tools such as Kelley Blue Book, which has been a trusted resource for the valuation of motor vehicles. You’ll want to investigate how quickly your car might depreciate once you buy it. Not all cars depreciate at the same rate, and some hold their value longer. This will make it less likely of you owing more than what it is worth and ending upside down.

Here's an example of the difference a resale value can make.

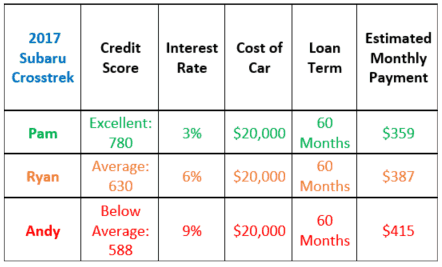

2. Secure a Great Interest Rate on Your Car Loan

You can do this by examining your credit before applying for the car loan. Getting the help of a credit expert will be a major advantage in this area. They can assist you with increasing your credit score to its fullest potential. Having a higher credit score will give you access to the best interest rates. A lower interest rate means a lower monthly payment, more going towards principle, paying off your loan quicker, and saving more money from avoiding higher interest!

Once you have your score at its fullest potential, shop around for the best interest rates. There is a misconception that you can only get financing from a car dealership. This is a myth! Consider rates at your primary bank and look up credit unions in your area or online. Securing a low interest rate will help you save throughout the lifetime of the loan and will close the gap on the value to loan amount of your car.

Here's an example of the difference your credit score and interest rate can make.

Pam will have less of a chance of being upside down as more of her monthly payment will be going towards her principle balance.

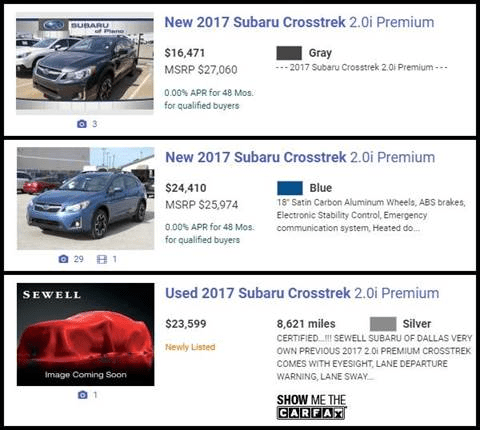

3. Look for the Lowest Price Possible On the Car You Want to Buy

Shop around for the best deal. Just as you shopped around for the best rates, the price of your car can also fluctuate depending on where you are shopping. When comparing your options, make sure all the specs match up for the same car, miles, year and features. Get an idea about the proper price of the car and don’t just consider dealership options. Consider online resources that may provide more affordable options such as Autotrader.com. Not finding a deal and overpaying for your car can put you upside down with your car loan.

We did a quick search for a model to see a comparison of prices available online.

4. Consider Making a Down Payment on Your Car

If your credit is good, you may not be required to make a down payment. Even if you are not required, this should be considered. Making a bigger down payment will lower your principal balance significantly. Lowering this balance will cut down your payoff time, making it less likely to end up upside down on your loan, and it will also help you secure a lower monthly payment.

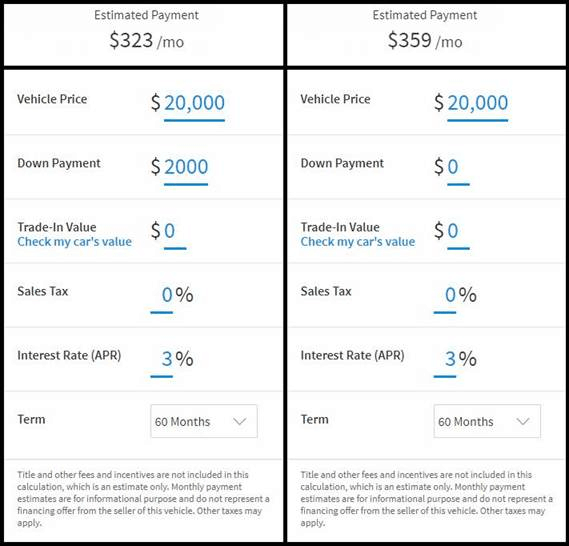

Here is an example of the difference a down payment can make.

5. Pay More Than the Minimum Monthly Payment

Just like any other line of credit or loan, when you finance you will have a minimum monthly payment. You can pay off your overall balance faster by making more than your minimum payment. By lowering your principal balance sooner, this will minimize the gap between the value of your car and your loan balance.

Looking for a car loan? Consult one of our credit experts to improve your credit score!

Are you preparing to apply for a car loan? Having an optimal credit score will make for a smoother process. If you’re unsure where your credit is at, it’s always a good idea to consult with a credit expert. MSI Credit Solutions assists consumers with credit services, real estate services, and lending resources.

Call MSI Credit Solutions today at 866-217-9841 and receive a FREE consultation.

MSI Credit Solutions provides superior credit restoration and comprehensive consulting services that are reliable and affordable. Call today for your free credit repair consultation! Contact us at (866) 217-9841.

MSI Credit Solutions provides superior credit restoration and comprehensive consulting services that are reliable and affordable. Call today for your free credit repair consultation! Contact us at (866) 217-9841.

*The information in this article has been provided strictly for educational purposes.