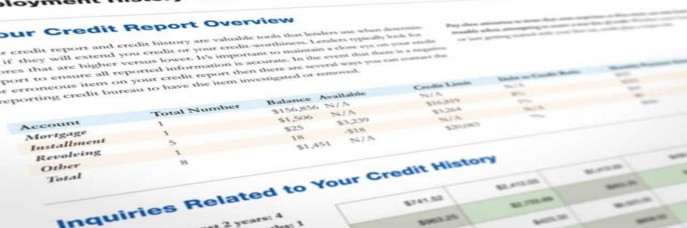

The credit score we discussed in our last post stems from your credit report. Your credit score is what will essentially “get your foot in the door,” but lenders will also refer to your credit report for more detailed information. In some instances you could have a decent credit score, but still reflect certain factors on your credit report that could hold you back from qualifying for a line of credit.

Contained in your credit report is your credit history and status of accounts. The factors that affect your score include how often you make payments, the timeliness of payments, how much debt is owed, and also the status of delinquent accounts. This will include your open accounts, late payments, collections and public records such as liens, judgments, and bankruptcies. As there are three different credit scores there are also three different credit bureau agencies. Each credit bureau agency will report its own individual information. This means that the account of “Credit123” reporting to Experian, may not report to TransUnion thus creating a different credit score with each agency.

Also contained within your credit report is personal information, although these factors do not affect your credit score. This will include names, date of birth, social security numbers, previous employment, and addresses. This information is gathered from credit applications that you have initiated. Although your personal information does not affect your score, the credit inquiries created from the applications will reflect within your report and do affect your score. These inquiries should remain on your report for no more than two years from the date initiated.

What is not included in your credit report?

- Gender

- Ethnicity

- Religion

- Political affiliation

- Criminal history

- Income information also does not reflect within your report. This creates frustration among some consumers who previously faced financial struggles. Although their finances would allow them to take on new credit lines they still cannot qualify due to their less than perfect credit.

Inaccuracies can potentially reflect in your credit report from a number of these categories. It is best to monitor your credit to capture any inaccuracies that may be affecting your credit status. Remember that you have the right as a consumer to challenge any inaccuracies you find. You can challenge these items on your own, or if you find the process to be difficult you can seek professional assistance such as MSI Credit Solutions.

MSI Credit Solutions provides superior credit restoration and comprehensive consulting services that are reliable and affordable. For any questions or to schedule a free credit consultation, contact us at (866) 217-9841.

MSI Credit Solutions provides superior credit restoration and comprehensive consulting services that are reliable and affordable. For any questions or to schedule a free credit consultation, contact us at (866) 217-9841.

*The information in this article has been provided strictly for educational purposes.