Are you trying to improve your credit score?

Consider these 4 tips to help you increase your credit scores!

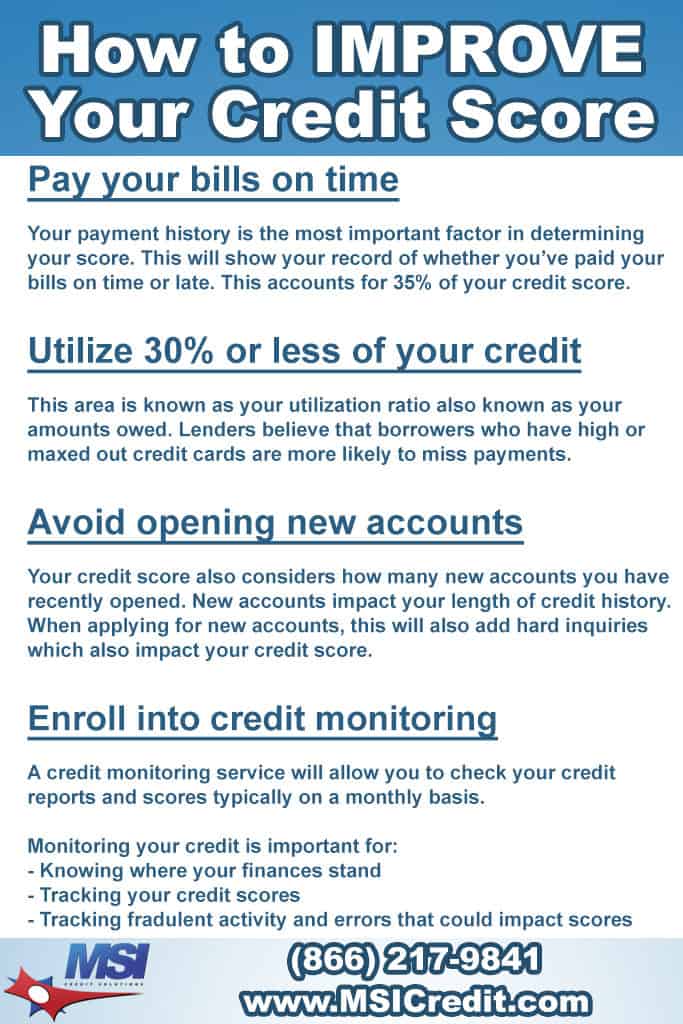

Pay Your Bills on Time

Your payment history is the most important factor in determining your credit score as this accounts for 35% of your credit score. This will show your record of whether you’ve paid your bills one time, or late.

Utilize 30% or Less of Your Credit

This are is known as your utilization ratio, also known as your amounts owed. Lenders believe that borrowers who have high or maxed our cards, are more likely to miss payments.

Avoid Opening New Credit Accounts

Your credit score also considers how many new accounts you have recently opened. New accounts impact your length of credit history. Applying for new accounts also adds hard inquiries which impacts your credit scores.

Enroll in a Credit Monitoring Service

A credit monitoring service will allow you to check your credit reports and scores typically on a monthly basis.

Monitoring your credit is important for:

– Knowing where you finances stand

– Tracking your credit scores

– Tracking fraudulent activity and error

Need help improving your credit score? Call us now!

Do you have anything negatively impacting your scores?

Contact us today for a FREE credit consultation

(866) 217-9841

MSI Credit Solutions provides superior credit restoration and comprehensive consulting services that are reliable and affordable.

*The information in this article has been provided strictly for educational purposes.