What Are Stall Tactic Letters?

- A stall tactic letter is a type of communication that creditors or debt collectors may send in response to a request for information, dispute, or payment plan. These letters typically include vague, non-committal language designed to delay the resolution of your issue or request. They often give the appearance of being helpful or responsive but, in reality, are simply intended to buy more time or discourage further action.

Some common characteristics of stall tactic letters include:

- Vague promises: The letter may state that the issue will be reviewed or processed in a certain amount of time without giving any clear answers or deadlines.

- Confusing language: Creditors may use complex or technical jargon that makes it difficult to understand what is actually being offered or communicated.

- Requests for more information: Sometimes, the creditor will ask for additional documents or details that are either unnecessary or irrelevant to the resolution of the dispute.

- Lack of specific action: The letter may acknowledge your dispute or request but take no concrete steps toward resolution.

While these letters may seem like an attempt to be accommodating, they are often a strategy to delay your progress or force you to drop your claim.

Why Do Creditors Use Stall Tactic Letters?

Stall tactic letters are often employed by creditors or collectors who are trying to avoid addressing the underlying issue. This could be due to several reasons:

- Avoidance of a Debt Discharge or Settlement: If a dispute involves the cancellation of debt or a settlement, the creditor may prefer to avoid giving an immediate response in hopes that the consumer will lose interest or the situation will resolve in their favor.

- Time as a Weapon: In some cases, the longer the dispute drags on, the more difficult it becomes to gather the necessary evidence or reach an acceptable resolution. Delays may be strategically used to wear down the consumer.

- Lack of Information or Responsibility: Sometimes, creditors don’t have the proper documentation or information to resolve a claim and may stall in order to avoid addressing a valid dispute.

Common Types of Stall Tactic Letters

Here are a few types of stall tactic letters that clients of MSI Credit Solutions may encounter:

- “We are reviewing your dispute” letters

- These letters simply state that the creditor is reviewing your dispute, but without any specifics. They often don’t give you a timeline for when the issue will be resolved, leaving you in limbo.

- “We need more information” letters

- Creditors may ask for additional documentation, sometimes even if you’ve already provided everything they need. The goal here is often to delay the process while they avoid taking action on the dispute.

- “We are unable to verify” letters

- In some cases, a creditor may claim they are unable to verify the information you provided, even though they may have all the necessary records in their possession.

- “Please call for more information” letters

- Instead of providing concrete answers in writing, creditors may suggest you call them for further details. This can be an attempt to keep you in a back-and-forth phone conversation, preventing you from getting clear, documented responses.

How MSI Credit Solutions Can Help

- If you’ve received a stall tactic letter, you don’t have to go through it alone. MSI Credit Solutions is here to assist you in handling these types of letters and ensuring that your credit repair process stays on track. Here’s how we can help:

- Evaluate the Letter’s Legitimacy

- Our team will carefully review the contents of the letter to determine if it’s a genuine response or just a delay tactic. We will help you understand whether the creditor is fulfilling their legal obligations or if they are attempting to stall the process.

- Strategic Response

- MSI Credit Solutions will craft a clear, professional response to the creditor. If necessary, we’ll escalate the issue or take further steps to ensure your dispute is being handled properly.

- Negotiation and Communication

- We can act as an intermediary between you and the creditor. Our team has experience in negotiating with creditors to expedite responses and ensure your rights are protected throughout the credit repair process.

- Legal Action (if Necessary)

- In some cases, if a creditor continues to stall or violate your rights under the Fair Credit Reporting Act (FCRA) or Fair Debt Collection Practices Act (FDCPA), we can advise you on potential legal action to hold them accountable.

How to Protect Yourself from Stall Tactics

While MSI Credit Solutions is here to help, it’s also important that you stay proactive. Here are a few things you can do to protect yourself from delay tactics:

- Keep detailed records: Document every communication with creditors. Save emails, letters, and notes from phone calls, as these may be valuable if you need to escalate the matter.

- Know your rights: Familiarize yourself with your rights under credit repair laws like the FCRA and FDCPA. If a creditor is stalling, they may be violating your rights, which can strengthen your case.

- Be patient but persistent: Credit repair can take time, and some delays are unavoidable. However, if you suspect that the creditor is purposefully stalling, don’t hesitate to follow up regularly and demand action.

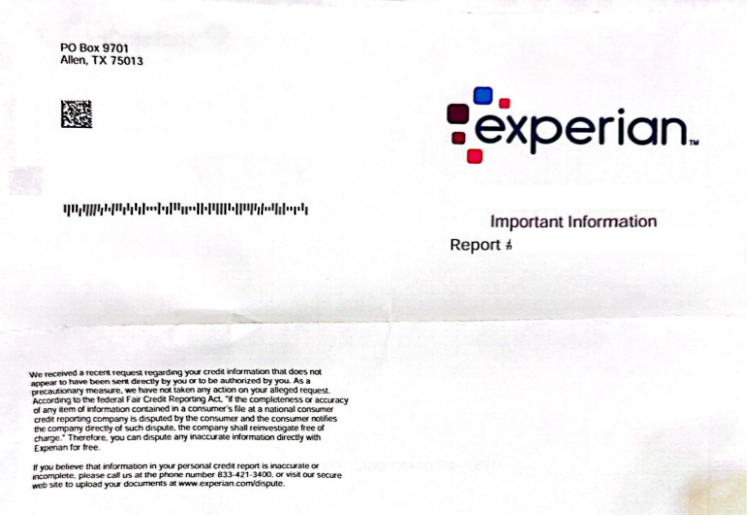

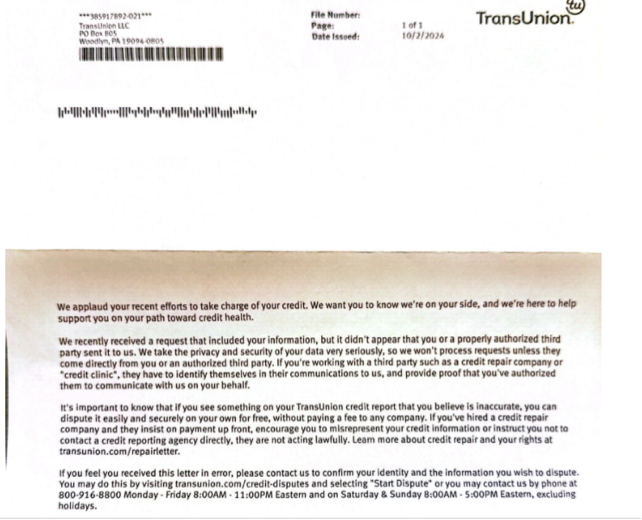

Stall Letter Example:

Conclusion

Dealing with stall tactic letters can be one of the most frustrating aspects of the credit repair process, but with the right knowledge and support, you can stay on track and keep moving forward. MSI Credit Solutions is committed to helping you navigate these challenges and ensure that your credit repair journey is as smooth and successful as possible.

If you’ve received a stall tactic letter or are experiencing delays in your credit repair process, contact MSI Credit Solutions today. Our expert team is ready to help you cut through the confusion and get the resolution you deserve!

Give us a call today for a free credit analysis and consultation!

(866) 217-9841

MSI Credit Solutions provides superior credit restoration and comprehensive consulting services that are reliable and affordable.

*The information in this article has been provided strictly for educational purposes.