Credit scores are used to determine the amount of risk of lending money to a consumer. The lower a credit score is, the more likely it is a consumer will default on their loan.

Your scores impact your chances of approval, rates, deposits, and more. Your credit scores can also affect areas like employment as some companies also check credit scores as part of an employee background check. Do you know where your credit scores rank?

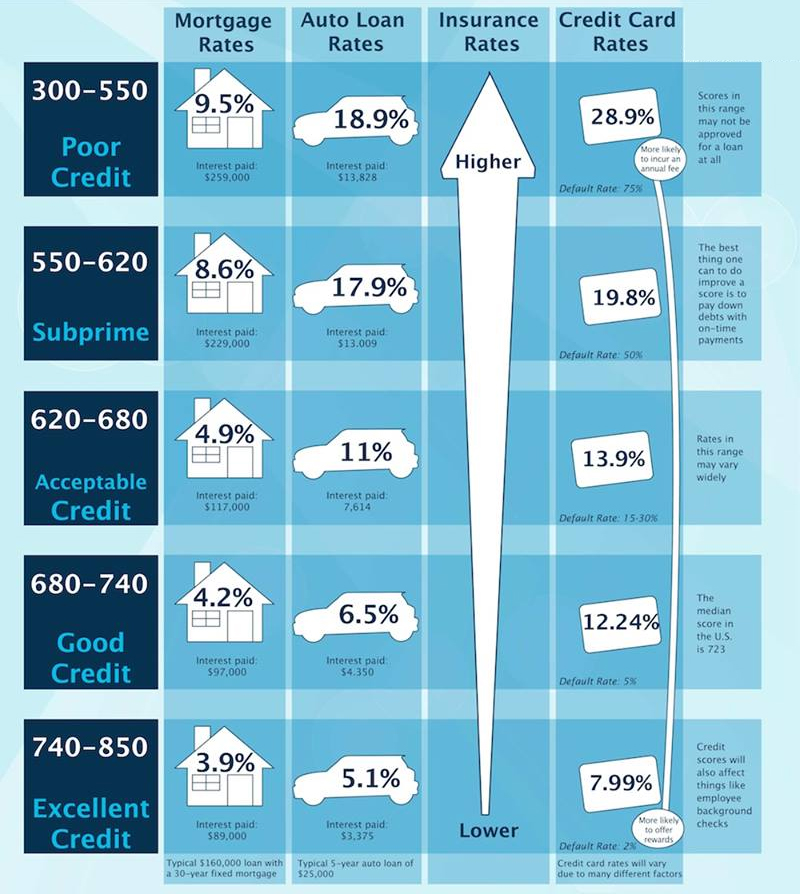

Credit Score Ranges

300-550: Poor Credit

- Default rate of 75%

- Most likely to incur annual fee on credit cards

- Highest rates

- Not likely to be approved for a loan at all

550-620: Subprime

- Default rate of 50%

- High rates

- Avoid adding any new debt or late payments to your credit

620-680: Acceptable Credit

- Default rate of 15-30%

- Rates in this range may vary widely, but consumers have better chances for approval and better rates

680-740: Good Credit

- Default rate of 5%

- The median score in the U.S. is currently 723

740-850: Excellent Credit

- Default rate of 2%

- More likely to be offered rewards on credit cards

- Lowest rates

- Best chances for approval

Need help to improve your credit score? Call us now!

Don’t waste time waiting around to find out what happens with your credit score. Start now to BE READY next year with great credit scores for all your financial needs.

Are you ready to improve your credit and increase your credit scores? We can help you!

Give us a call today for a free credit analysis and consultation!

(866) 217-9841

MSI Credit Solutions provides superior credit restoration and comprehensive consulting services that are reliable and affordable.

MSI Credit Solutions provides superior credit restoration and comprehensive consulting services that are reliable and affordable.

*The information in this article has been provided strictly for educational purposes.