To wrap up our Managing Debt series the final step is one of the most important. Monitoring your credit reports will not only help you keep track of your debts as they reflect on your reports, but it will also be a good reference to see how your credit is being established. The history you establish now may ultimately determine your future purchases.

Now that you have a plan to manage your debt it may be best to double-check your reports. You can check to make sure your payments are being considered on your report. With monitoring your reports you may also find inaccuracies that could be affecting your credit and scores. With my personal experience, as I discussed in our last blog, I had caught some suspicious activity on my bank statements which actually prompted me to check my reports. Luckily there were no questionable accounts or inquiries reporting. You’d be surprised how many stories are out there of people who never knew their credit was compromised, but had they monitored their credit reports they would have seen a red flag.

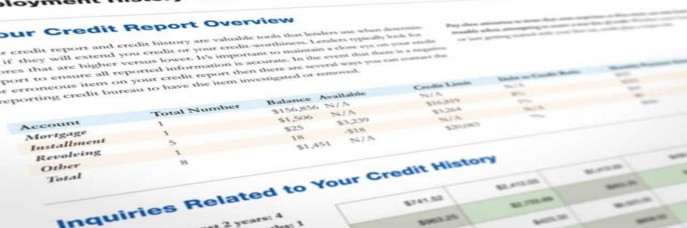

Credit monitoring is a great tool to have to assure everything is in order. Credit monitoring services can provide you tools such as monthly reports, credit scores and fraud alerts should any new info be added. This is especially a great tool to have in situations when you are planning to apply for a new line of credit as you can be sure to catch any red flags before applying.

MSI Credit Solutions provides superior credit restoration and comprehensive consulting services that are reliable and affordable. For any questions or to schedule a free credit consultation, contact us at (866) 217-9841.

*The information in this article has been provided strictly for educational purposes.