By

Kevin Salas

What is a debt-to-income ratio or DTI?

If you’re new to the world of debt, or just want to learn a little more about how your debt-to-income ratio works, you’ve come to the right place.

The debt-to-income ratio is a key indicator of your ability to pay back your debts. It’s calculated by dividing your total monthly debt payments by your gross monthly income—that is, all the money that comes in before any taxes or expenses are taken out. The higher this number is, the worse it looks on your credit report, and the less likely it is that lenders will trust you with more loans in the future.

Why is it important to have a low debt-to-income ratio?

The debt-to-income ratio is a key indicator of your ability to pay back your debts. It’s calculated by dividing your total monthly debt payments by your gross monthly income—that is, all the money that comes in before any taxes or expenses are taken out. The higher this number is, the worse it looks on your credit report, and the less likely it is that lenders will trust you with more loans in the future.

Furthermore, the reason why this metric is so important is that it doesn’t just look at how much money you make—it also considers what kind of debt you have and how much it will cost you to pay it off. For example: if you had $300 in credit card debt with a 19% interest rate as well as another $4,000 in student loans with 0% interest and no payments due until graduation day (which could be years away), then your debt load would actually be quite high even though it seems lower than the average person because of those two factors: the fact that they’re both fixed-interest rates and they’re not due at once so they’ll be spread over time.

Who is looking for a good DTI?

If your debt-to-income ratio is too high, lenders may be reluctant to give you a loan like an FHA loan, it’s the same idea with credit card companies. They’ll be worried that if something happens and you can’t make those payments for a month or two (or more), then they’ll be on the hook for more money than they can afford. Here’s a list of lenders or organizations that will check your DTI.

- Mortgage lenders

- Auto loan lenders

- Credit card companies

- Bank loans

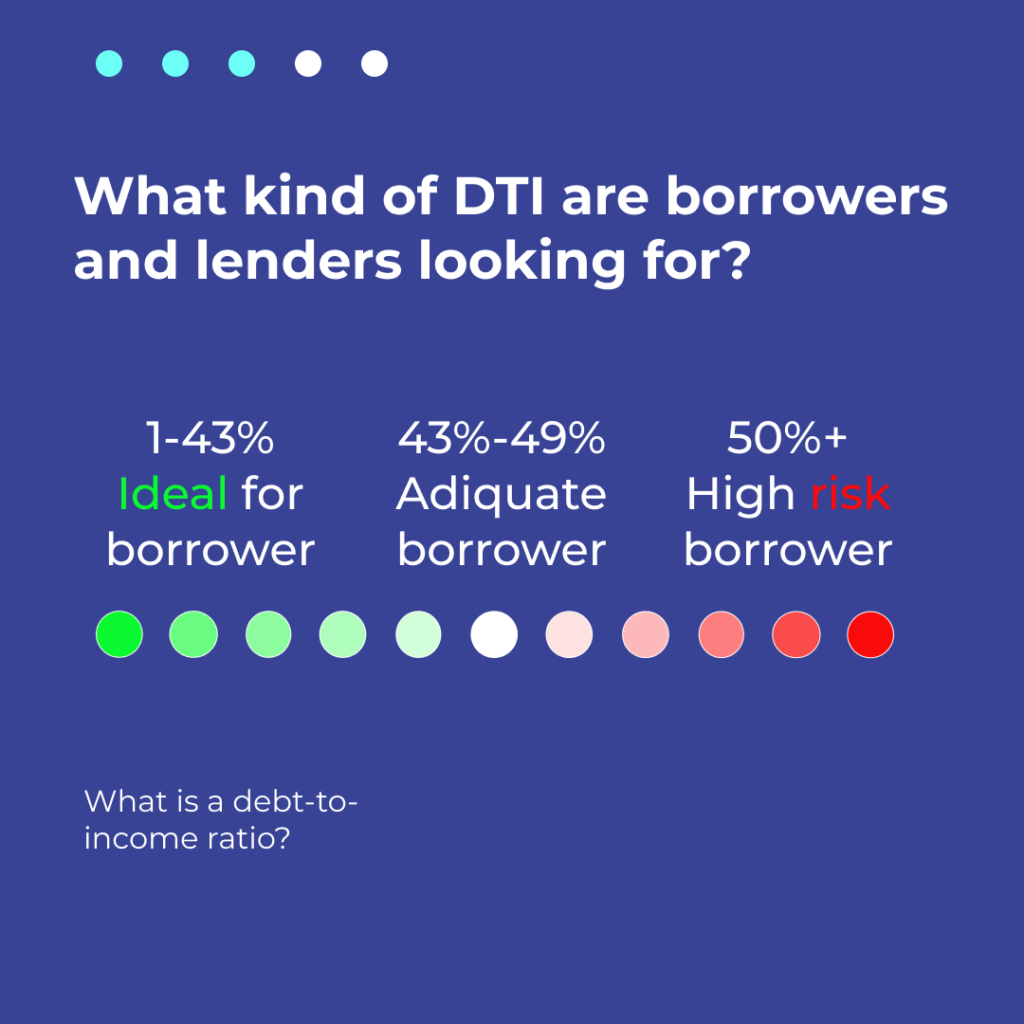

What kind of DTI are mortgage lenders looking for?

The debt-to-income ratio is a number that lenders use to determine how much money you can spend on your mortgage, as well as what kind of loan you should get and at what interest rate. The ratio is calculated by dividing your total monthly debt payments by your gross monthly income.

In 2022, most lenders will want to see a debt-to-income ratio of less than 50%. More specifically a mortgage lender is looking for a debt-to-income ratio of 43% or less. That means that for every dollar you earn, you should only be spending 50 cents on debt payments. This includes things like credit cards and student loans. If you have more than one type of debt, add up all of your monthly payments and divide by your monthly take-home pay.

Front-end vs back-end DTI ratio

Front-end DTI

Front-end debt to income ratio is the ratio of your monthly housing payment and other debt payments, like student loans and car payments, to your gross income.

Back-end DTI

Back-end debt to income ratio is the ratio of your total monthly debt payments, including all of your housing, student loans, car payments, and any other form of debt, to your gross income.

The difference between front-end DTI ratio and back-end DTI ratio is that the front-end ratio includes all debts with payments due within a certain time period, while the back-end ratio includes all debts with payments due after a certain time period.

How can I improve my DTI ratio?

One way to improve your debt-to-income ratio is to save up some money and pay down debts. This way, you’ll be able to show that you have the ability to pay back loans. If you don’t have any savings and you’re only making it by a hair, lenders may be warier of lending money to you because they think that if something bad happens, like losing your job, you won’t be able to pay them back.

Another way is by increasing your income. This can be done by getting a raise at work or finding another job where you make more money.

You can also reduce your expenses by downsizing your home—maybe moving into an apartment instead of buying a house—or cutting back on expenses like cable TV or eating out more often.