What is a 1099 C?

What is a 1099-C? A 1099-C is used to report Cancellation of Debt Income. The lender is supposed to file the 1099-C when it cancels $600 or more of debt. A

What is a 1099-C? A 1099-C is used to report Cancellation of Debt Income. The lender is supposed to file the 1099-C when it cancels $600 or more of debt. A

Credit Repair Services Credit repair is a service that can be provided by a professional company such as MSI Credit Solutions or can be done on your own. There are

Credit Repair Services Credit repair is a service that can be provided by a professional company such as MSI Credit Solutions or can be done on your own. There are

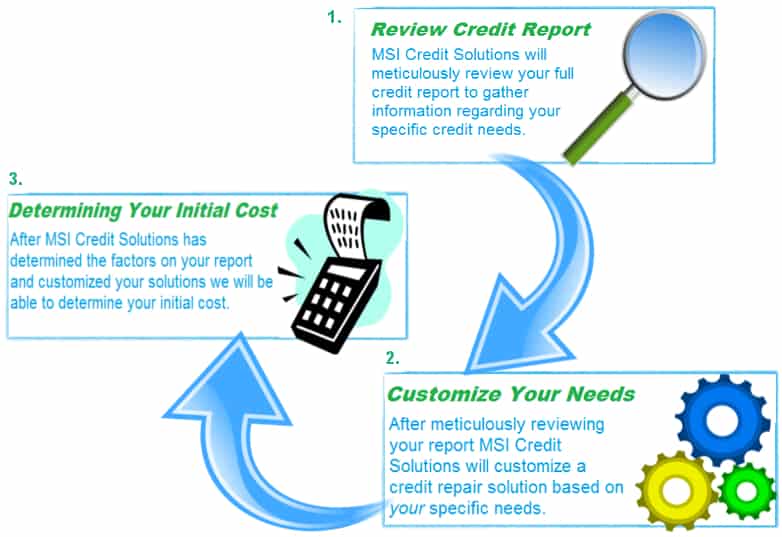

No two credit reports are the same. Therefore, it is crucial to meticulously review your full credit report. By reviewing your credit report, we are able to gather information such

If the credit repair process is too strenuous or tedious for you, there are a couple of things to consider before hiring professional assistance. There are many choices available for

There are only seven more days until Christmas. Even though there’s only a week left many will still head out to do some last minute shopping. We wanted to provide

We are happy to announce that we have had another successful year! After 7 years, MSI continues to help people repair their credit and start all over again! Thousands of

Thanksgiving is this week and after all the festivities on Thursday many will flock to stores for holiday deals. Things can get pretty stressful around this time of the year,

Credit repair is the process of: Identifying errors reflecting within your credit report. Disputing the information in question. Auditing and monitoring the three credit agencies Equifax, Experian and TransUnion to