As if credit wasn’t hard enough to understand, consumers often face difficulties understanding differences between reports. We will be covering some of the main questions we face from our clients.

Does pulling my credit report hurt my scores?

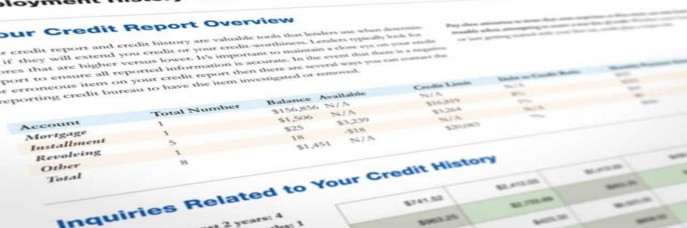

This question will depend on what type of inquiry you are making. If you are initiating an application this will be what is called a hard inquiry. This will reflect on your credit report and remain on your report for up to two years. The more hard inquiries that you initiate the more risk you are applying to your credit scores as 10% of your credit score focuses on you taking in more debt. So what does this mean? Simply put, if the line of credit you are thinking of opening is not an absolute necessity it is not recommended for you to apply for it. Ultimately it is best to consult with a finance manager, banking institution, or credit consultant.

If you are curious as to where your credit stands you have other options. The Fair and Accurate Credit Transaction Act gives consumers the right to obtain a free credit report once a year from each of the three credit reporting agencies: Experian, Equifax and TransUnion. To obtain this free report be sure to visit www.annualcreditreport.com or call toll-free at 877-322-8228. Additionally this report is not a hard inquiry but instead a soft inquiry. Unlike hard inquires soft inquiries do not reflect on your credit report or affect your score. Any other websites such as the commonly known freecreditreport.com will hook consumers with so-called “free reports” when in reality it is marketing other services, and if not careful will sign you up into a credit monitoring program.

Why are my scores different?

This question has different variables. It all depends on what kind of report is provided to you. We are more commonly seeing VantageScore reports as well as more known FICO score reports. So what’s the difference? It’s as if you were comparing apples to oranges! The more traditional FICO score ranges from 350-850. The VantageScore on the other hand ranges from 501-990 and parallels a grading system of A to F (901-990 = A, 801-900 = B, 701-800 = C, and so on). With FICO, a score of 720 is considered as a good credit score. However, a 720 with VantageScore would reflect as a grade “C” in which lenders may view you as a higher risk.

Also, if you are purchasing your FICO score from more than one of the three credit bureaus you may be surprised to find a different score on each individual bureau. This occurs because the data on file with the three credit bureaus may vary. In addition to selling the FICO score the credit bureaus, lenders and other score providers may promote their own proprietary scores. These proprietary scores and other non FICO scores can also vary widely with each different source because in addition to the varying data on file they may have, they could additionally use a different formula for scoring or a different scale.

For any additional information, or if you have any questions feel free to leave us a comment, call us toll free at 866-217-9841, or visit our website at www.msicredit.com.

MSI Credit Solutions provides superior credit restoration and comprehensive consulting services that are reliable and affordable. For any questions or to schedule a free credit consultation, contact us at (866) 217-9841.

*The information in this article has been provided strictly for educational purposes.