Your credit history is a record of your credit accounts. The credit bureaus Experian, Equifax and Transunion each keep detailed records of your accounts and payment history. This information becomes especially important when you apply for new lines of credit such as credit cards, loans and mortgages.

How do credit bureaus use your credit history?

Credit history is useful because it shows lenders how reliable you are with financial responsibilities. Credit bureaus use your credit history to calculate your credit score and “creditworthiness”, which is a snapshot of how likely you are to pay off a debt in the future. Bureaus go through your history and try to assess your reliability, so they’ll know how to set their lending rates.

Establishing a healthy credit history can help in many areas. A higher credit score can result in lower mortgage rates, a lower APR for your credit cards, lower insurance premiums and better rewards on credit cards.

What kind of information is in your credit history?

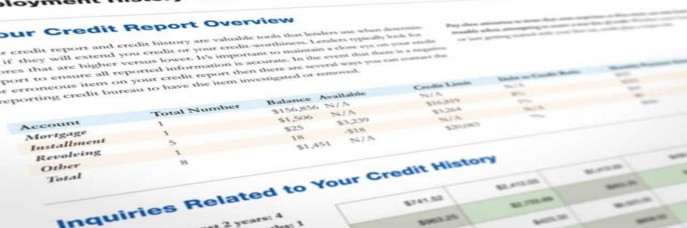

1. Lines of credit- Your credit cards, loans and mortgages are all on your credit history. You’ll also find the date the account was issued, the amounts owed, the credit limit for credit cards and payment history.

2. Inquiries- Any time you apply for a new line of credit, the lender will check your credit history, initiating a “hard inquiry” on your report. Hard inquiries can deduct a few points from your credit score though the impact will decrease over time. Inquiries can reflect on your credit history for 2 years.

3. Derogatory items- If you become severely delinquent in your payments and your account is sent to a collections agency, the account in collections will be noted on your credit history. Derogatory items can reflect on your credit history for 7-10 years.

4. On time payment history- If you are 30, 60 or 90 days late on a payment, it will reflect on your credit history, and will negatively impact your score.

What should you do if your credit history is incorrect?

An up to date and accurate credit history is very important in ensuring you have the best credit score possible. A change in your credit score indicates a change in your credit history. If you’re concerned that your credit history is inaccurate contact us today at 1-866-217-9841 or visit us online at www.msicredit.com. Our credit repair consultants are open to discuss your credit history and how it is impacting you today.

MSI Credit Solutions provides superior credit restoration and comprehensive consulting services that are reliable and affordable. For any questions or to schedule a free credit consultation, contact us at (866) 217-9841.

*The information in this article has been provided strictly for educational purposes.