Buying a home, whether it be your first go or your third time at it, can be a pretty intense process. To help ease this process, we have provided a checklist to help you keep track of the must do’s in the home buying process. So before you take the leap towards buying your first home, consider some of these steps and ease your stress. Today we will be covering a checklist to prepare for the qualification of your home purchase.

- Avoid Any Major Changes

- When you are going through the prequalification process, lenders will be observing everything with a close eye. The last thing you want to do is make a major change in your life that could affect your qualification.

- While you are in the process of purchasing a home, taking a new job or making a change in your career could risk your chances of being approved. An individual with a new job does not have much history of job security, so lenders can see it as too big of a risk. Many lenders require at least two years of history with your current employer. Some lenders may be able to move forward with you if you have recently taken new employment, as long as it is still within the same career field.

- You want to stay away from making any big purchases right before applying for your home loan. Again, lenders are looking to see how much of a risk factor you are. For example, a new $20,000 auto loan will add fresh new debt to your report and affect your DTI (debt to income) ratio, which will consequently cause a decrease in your score temporarily due to the new balance and minimal payment history.

- Check Your Credit Before Applying

- Find out where you stand and pull a consumer (soft inquiry) report and be proactive. Soft inquiries do not hurt your credit score. Having a qualifying credit score is what will “get your foot in the door” with lenders. By checking your credit prior to applying, you may be able to catch any surprises, or make some adjustments such as lowering credit card balances to allow for a higher score. Lenders will have to eventually check your credit which does cause a hard inquiry (hard inquiries do report on your credit and can potentially affect your scores), but at this point you can rest assured knowing where you stand with your credit.

- Did you find any surprises, unverifiable balances, accounts you don't recognize, or anything outside the norm? Dispute these items yourself, or seek professional assistance from companies such as MSI Credit Solutions. Auditing these items could result in a deletion if they are inaccurate or unverifiable, and additionally result in an increase to your credit score.

- Credit monitoring is an important financial tool at all times, even after purchasing your home. See our previous article, Managing Debt: Monitor Your Credit Reports for more information.

- Obtain a Pre-Approval

- Just as you do not want to apply blindly for your home loan, you also do not want to shop blindly for your home. Find out what you are approved for. Many consumers find themselves set on a home of their dreams that they may not necessarily be able to afford. Your credit score is only one factor lenders use to prequalify you. The other factor they will also consider is your DTI ratio. Even consumers with perfect credit may not have the perfect DTI ratio, thus not allow them to qualify for as much house as they expected.

- Shop & Compare Competitive Interest Rates

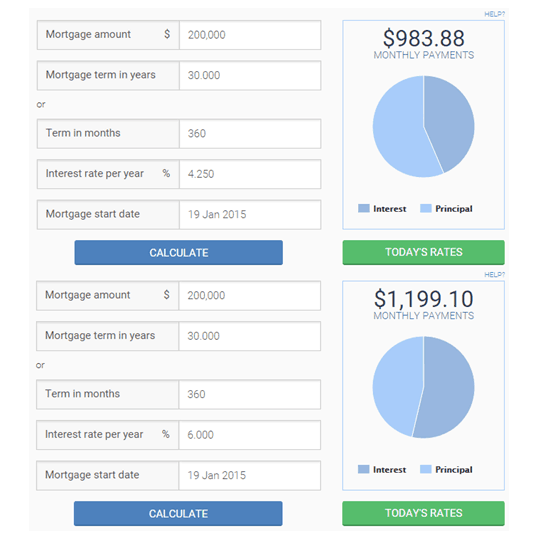

- Obtain at least four quotes from four different lenders. Although we covered hard inquiries in our previous step, scoring systems will typically count all home loan inquiries within a 14 day period as only one inquiry. By shopping and comparing rates from different lenders, it will allow you find the best offer available to you. This step is imperative if you want the potential to save thousands with one of the biggest purchases you are making in your lifetime.

- Budget Expenditures

- Buckle down on your finances and save what you can to go towards expenditures for your home. Some of these expenditures will include:

- Down payment

- Earnest Money

- Home inspection and appraisal costs

- Closing costs

- When it comes to the down payment and closing costs there may be options available to assist you in this area. Do some research, and see if there are any down payment assistance or grant programs available in your area. Did you save more than what you needed at closing? Great! Keep saving towards this nest egg for any renovations or upkeep expenditures for the future. You may find that a couple years down the road, that funky wallpaper isn't as cool as you initially thought it was when you first purchased your home.

- Buckle down on your finances and save what you can to go towards expenditures for your home. Some of these expenditures will include:

Following these steps will help better prepare you for the qualification process and help you eliminate the stress of purchasing your first home. For any questions regarding your credit and potential qualification for a home loan contact us today. Not only can we assist you with credit repair needs, but we can also refer you to professional lenders through the Loan Assistance Program and help you from beginning to end with our services.

MSI Credit Solutions provides superior credit restoration and comprehensive consulting services that are reliable and affordable. Call today for your free credit repair consultation! Contact us at (866) 217-9841.

*The information in this article has been provided strictly for educational purposes.